Key Takeaways

-

Swing trading involves holding trades for several days to capture broader price moves. It sits between scalping and long-term investing in terms of speed.

-

Traders combine chart analysis with news catalysts to find high-probability entries and exits.

-

This style suits traders who can’t monitor markets all day but still want regular trading opportunities.

-

Patience, a clear plan, and strong risk management are essential, especially in crypto’s fast-moving environment.

Introduction

Swing trading is like running a middle-distance race—it’s more relaxed than scalping but still focused on short- to mid-term gains. Trades often last from a few days up to two weeks, giving you time to analyze and act without needing to stare at charts 24/7.

Many crypto traders prefer swing trading because it allows them to stay active in the market without the stress of constant decision-making. Instead of chasing every small move, you’re aiming for larger, more deliberate trades.

If you’re just getting into active trading and want more room to breathe than scalping offers, swing trading might be the sweet spot.

How Swing Trading Works

The core idea of swing trading is to catch a portion of a market move, getting in near the start and out before it turns.

For example, if Bitcoin breaks above resistance and gains momentum, a swing trader may enter and hold for several days, exiting when momentum weakens. Traders use the daily and 4-hour charts, combining technical indicators and sometimes news like project updates or global economic changes.

Because swing traders don’t sit at their screens all day, they typically set:

-

Predefined entry and exit points

-

Stop-losses to manage risk

-

Trading alerts or bots for automation

Swing Trading vs. Day Trading

-

Swing Traders: Hold positions for days or weeks.

-

Day Traders: Open and close trades within a single day.

Day trading requires intense focus and rapid execution. Swing trading allows for more planning, fewer trades, and less screen time.

For beginners, swing trading is generally less overwhelming and easier to stick with consistently.

Popular Swing Trading Strategies

-

Trend Following: Spot an established trend and enter on pullbacks. If ETH is rising steadily, buy dips.

-

Support/Resistance Bounces: Buy near strong support, sell near resistance. Watch for reversal signals.

-

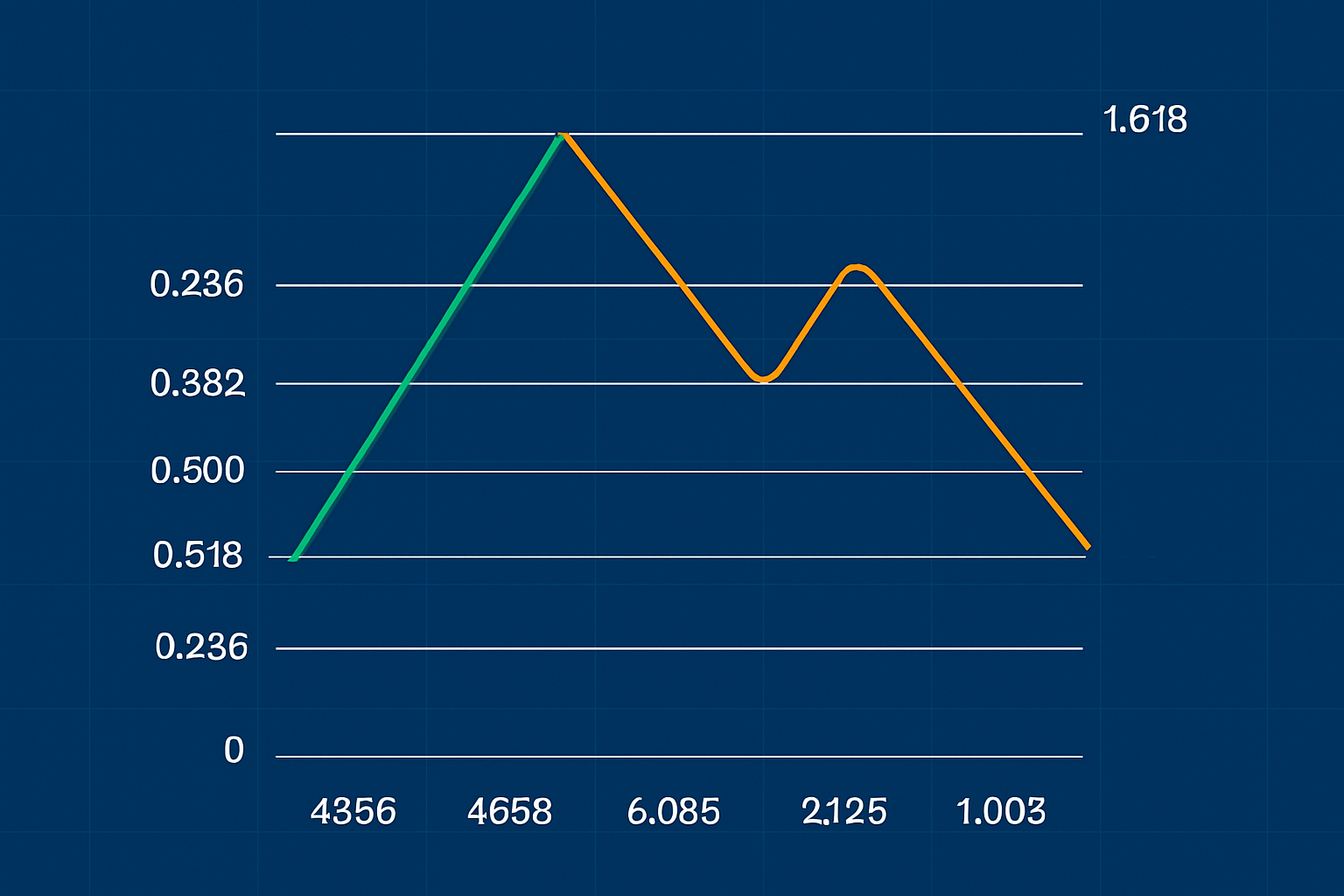

Moving Average Crossovers: When short-term averages cross above long-term ones, it often signals a new move.

-

Breakouts: Identify tight price consolidations and trade the breakout when volume spikes.

Tools for Swing Traders: To be effective, use:

-

TradingView for analyzing 4H and daily charts

-

Reliable exchanges like Binance or Bybit

-

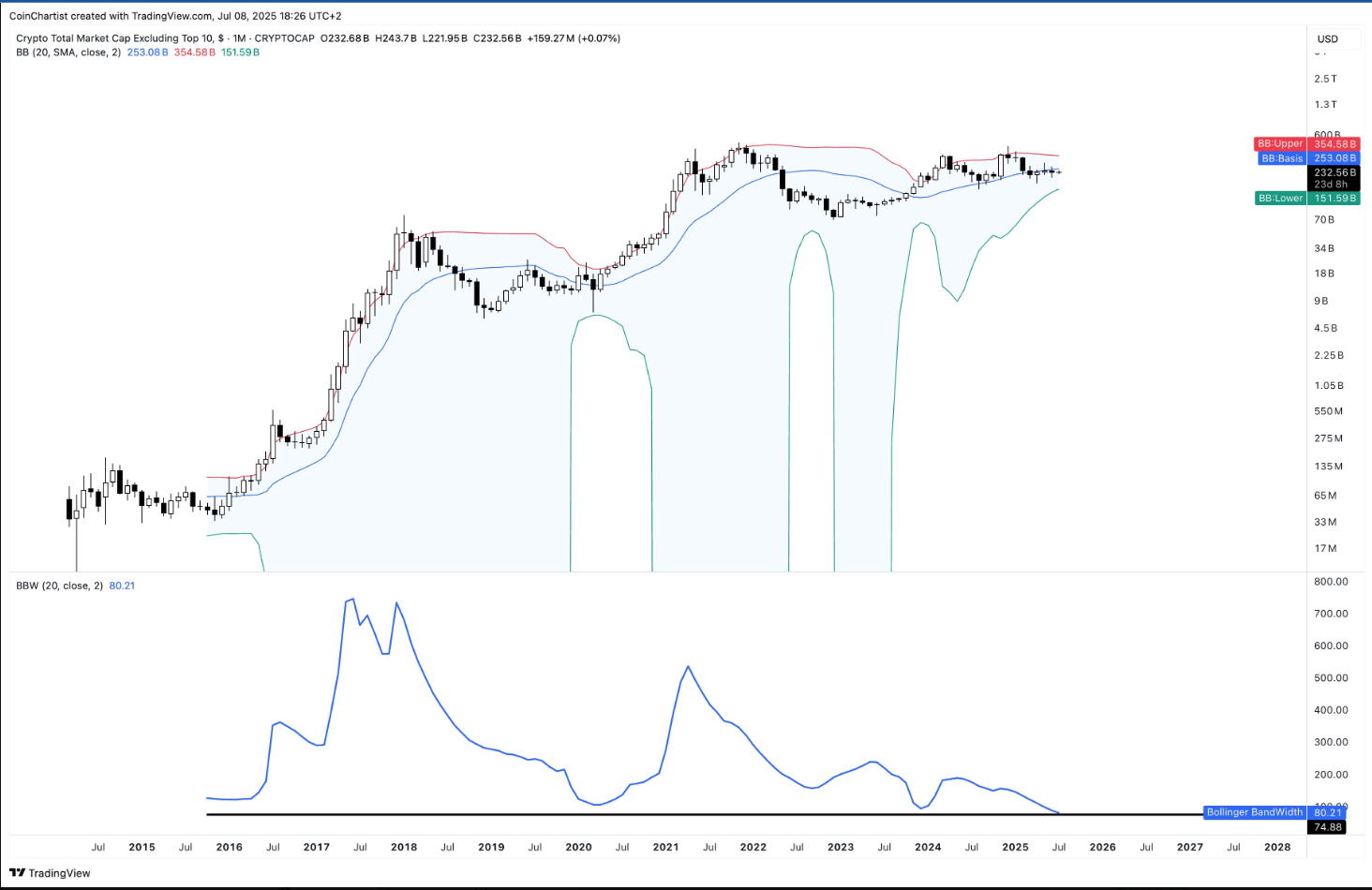

Indicators such as RSI, MACD, Bollinger Bands

-

News trackers like Twitter/X or CoinDesk

-

Stop-loss rules and a minimum 1:3 risk-reward ratio

Pros :

-

Less time-intensive than day trading

-

Bigger moves, fewer trades

-

Suits flexible schedules

-

Lower trading fees due to fewer entries

Cons:

-

Exposure to overnight/weekend price gaps

-

Patience is required

-

Emotional control is vital

-

Market reversals can still hit hard

Is Swing Trading Good for Beginners?

Absolutely. Once you know the basics of crypto and technical analysis, swing trading offers a great way to stay engaged without the stress of high-frequency trading.

Tips for getting started:

-

Start small while learning

-

Use stop-loss orders every time

-

Keep a journal for trade reviews

-

Stick to stablecoins like BTC or ETH

Closing Thoughts

Swing trading strikes a balance—it’s active but not frantic. You can trade around a busy schedule and still catch meaningful moves. With a solid plan, steady mindset, and ongoing learning, swing trading can be a rewarding entry into crypto markets.

Stay patient. Trade smart. Let the market come to you.