Key Takeaways

- Scalp trading is a fast-paced strategy that targets small price changes, often executed through numerous trades per day.

- Success relies on sharp execution, technical skills, and real-time data.

- Scalping requires intense focus, stamina, and strict risk control. Beginners are encouraged to paper trade first.

Introduction

Are you constantly glued to your 1-minute chart? Do you enjoy jumping in and out of trades before the average investor finishes their research? If so, scalping might be your trading style.

Scalpers aim to take advantage of tiny price moves to book quick profits repeatedly. They’re not looking for huge gains in one go, but small, consistent wins that add up over time. This style is demanding, risky, and not for everyone, but when done right, it can grow your portfolio steadily. Let’s break it down.

What Is Scalp Trading?

Scalp trading is a form of short-term trading where traders aim to benefit from small market movements, often entering and exiting positions within seconds or minutes.

Rather than targeting big swings, scalpers try to accumulate gains from dozens—or even hundreds—of micro trades. Over time, these gains can compound.

Scalping is widely used across markets, including stocks, forex, and crypto. In crypt,o especially, where price volatility is high, scalping opportunities are frequent.

Risks of Scalp Trading

1. High Risk, High Pressure

Small windows of opportunity mean there’s little room for error. A few bad trades can wipe out an entire day’s profit.

2. Time-Consuming

Scalping requires intense concentration. You must monitor charts constantly and react in real-time.

3. Mentally Draining

Fast decision-making under pressure is emotionally exhausting. Discipline is crucial to avoid revenge trading or overtrading.

4. Trading Fees

Frequent trades mean higher fees. Make sure your platform offers low-cost transactions or the profits may be eaten up.

5. Competing with Bots

Many short-term trades are executed by high-frequency bots. Manual traders must be sharp to stay competitive.

How Scalp Trading Works

Speed and repetition define scalping. Traders mostly rely on technical indicators and price patterns to find short bursts of volatility.

Occasionally, news-based trades also provide opportunities. The idea is not to ride entire trends but to take small bites of price movement.

Example:

Buy BTC at $66,000 and sell at $66,050 for a $50 move. If you trade 2 BTC, that’s a $100 gain. Do that 10 times a day, and it adds up.

Time Frames for Scalping

Scalpers use lower time frames such as:

- 1-minute

- 5-minute

- 15-minute

However, high time frames like 4H or daily are often used to determine the overall market trend before zooming in for entries.

Best Technical Indicators for Scalping

- Moving Averages (EMA/SMA)

- RSI (Relative Strength Index)

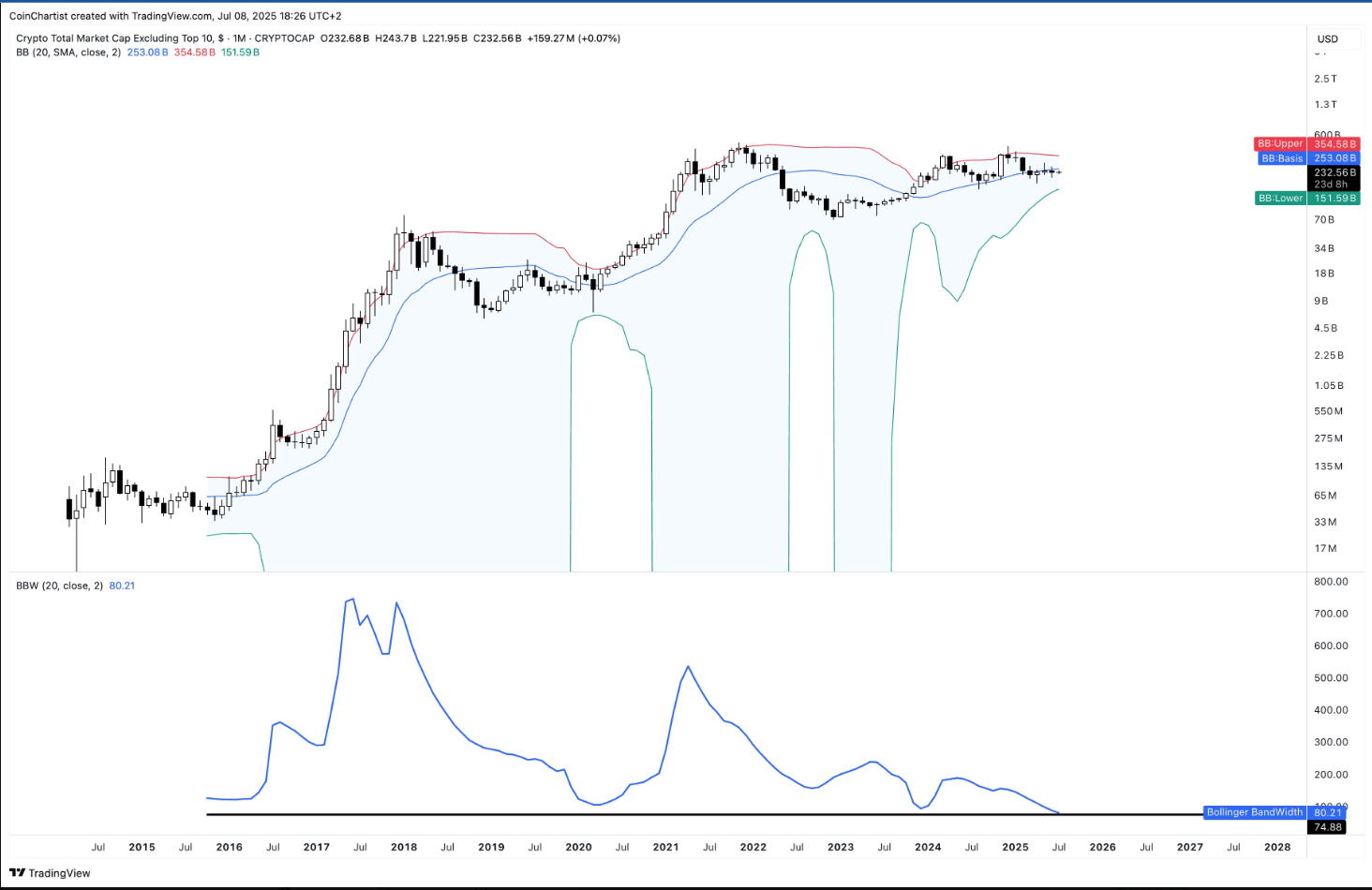

- Bollinger Bands

- VWAP (Volume Weighted Average Price)

- MACD

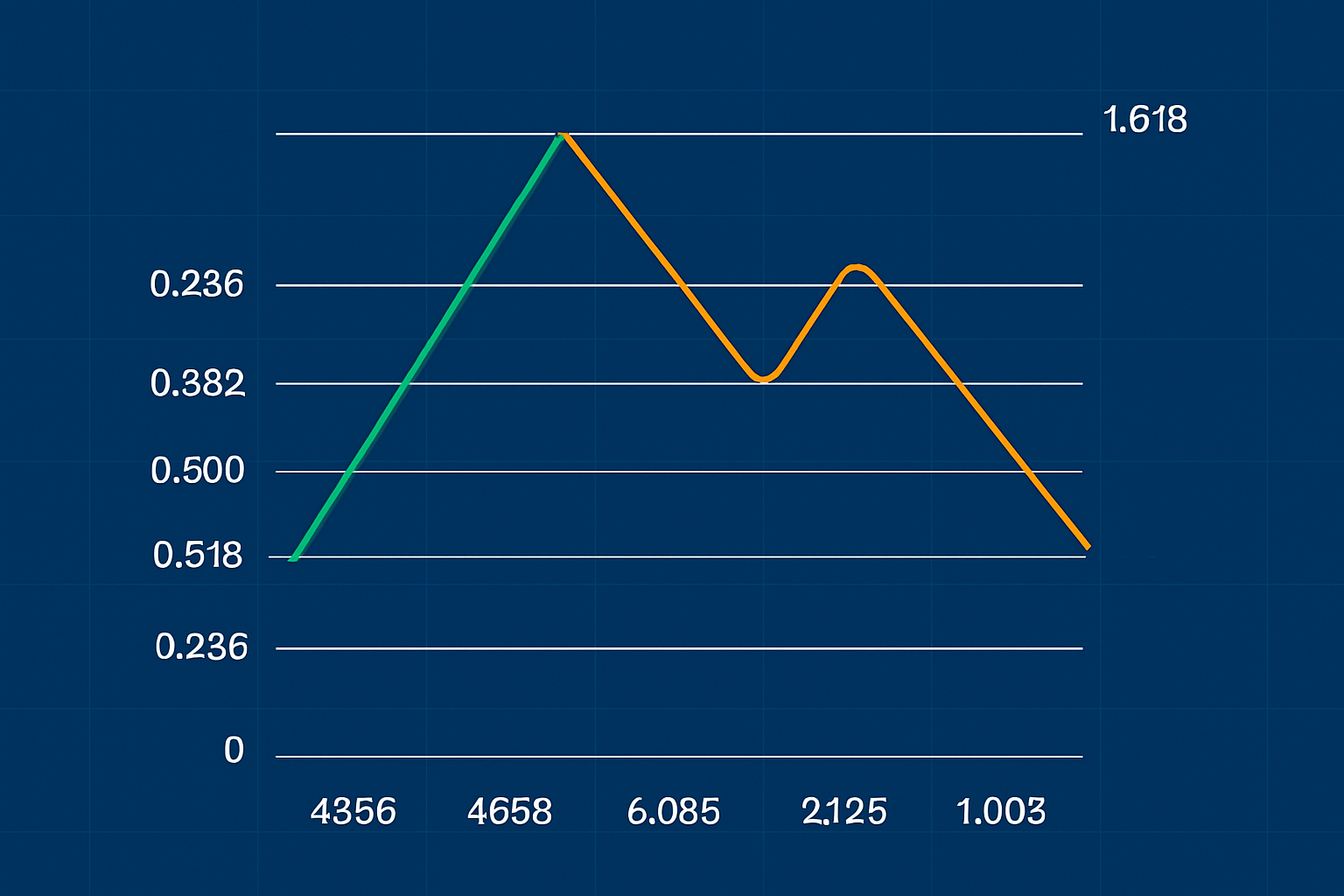

- Fibonacci Retracement

- Candlestick Patterns

Advanced scalpers also look at:

- Order book depth

- Volume profile

- Open interest

Crypto vs. Traditional Markets

Crypto markets are 24/7, offering more opportunities but also increased volatility. Unlike traditional markets that close overnight, crypto requires round-the-clock risk monitoring.

Scalping stocks might be limited to peak hours, while crypto can move sharply during any session worldwide.

Common Scalping Strategies

1. Discretionary vs. Systematic

- Discretionary: You decide in the moment, based on intuition and market context.

- Systematic: You follow predefined rules and execute based on triggers.

2. Range Scalping

Identify a price range. Buy low, sell high within the range—until it breaks.

3. Bid-Ask Spread

Exploit the gap between buy and sell orders. Best suited for algo or quant traders.

4. Momentum Scalping

Jump in when price breaks out with strong volume, and ride the wave briefly.

5. Mean Reversion

Use indicators like RSI or Bollinger Bands to spot overbought/oversold zones, then trade the bounce back to the mean.

Is Scalp Trading Legal and Profitable?

Yes, scalping is legal in most markets. Profitability depends on execution, risk management, and trading psychology. It’s not easy—but with a refined approach and proper tools, many traders succeed.

Is Scalping Right for You?

It depends on your trading style and personality. If you don’t like holding trades overnight and enjoy quick decision-making, it might fit you. If you prefer low-stress trades with more time for analysis, swing or long-term trading may be better.

Tip: Try paper trading first to test your strategy without financial risk.

Closing Thoughts

Scalp trading is intense and requires discipline, speed, and emotional control. While the potential for fast gains exists, so does the risk of quick losses.

For beginners, it’s wise to master longer time frame strategies before diving into scalping. If you’re experienced and thrive under pressure, scalping can be a powerful technique when used with the right tools and mindset.

Trade fast. Think faster. Always manage your risk.