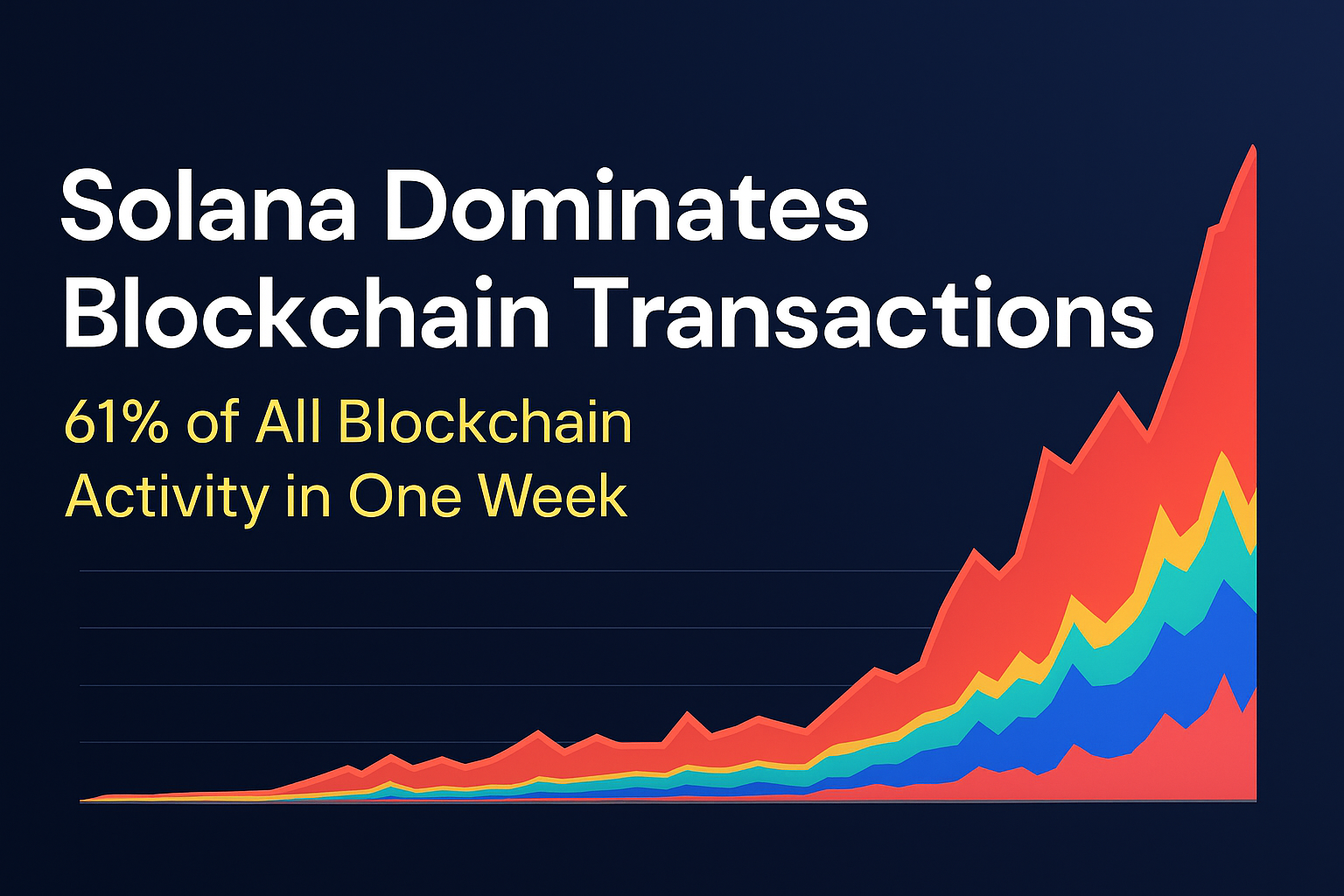

Solana Breaks All-Time High in Blockchain Activity

The blockchain world hit a historic milestone last week as total on-chain transactions across all networks reached a new all-time high (ATH). Surprisingly — or perhaps not — Solana accounted for a staggering 61% of those transactions.

This news comes just two years after critics claimed Solana was “dead” following multiple outages and market downturns. But recent data proves otherwise: Solana is not only alive but thriving.

Solana’s Transaction Dominance in 2025

| Blockchain | Transactions |

|---|---|

| Solana | 209,203,093 |

| BNB | 60,971,081 |

| Tron | 15,554,864 |

| Base | 13,669,645 |

| Polygon | 8,166,268 |

| Ethereum | 7,528,736 |

| Arbitrum | 5,786,325 |

| Other | 4,839,755 |

| TON | 3,465,357 |

| Bitcoin | 2,656,498 |

| Worldchain | 2,372,374 |

| Sei | 2,098,874 |

| Optimism | 1,487,033 |

| Abstract | 1,474,756 |

| Unichain | 1,244,913 |

| Avalanche C | 1,090,784 |

According to Dune Analytics, Solana recorded over 209 million transactions in a single week, outpacing every other blockchain, including Ethereum, Polygon, and BNB Chain.

Blockchain Weekly Transaction Count Breakdown

Why Is Solana Leading the Pack

Key Reasons Behind Solana’s Surge

High-Speed, Low-Cost Transactions

Solana’s architecture allows for thousands of transactions per second with almost negligible fees, making it ideal for high-frequency use cases.

- Rise of Meme Coins and Pump.fun Ecosystem

Projects like Pump.fun and the viral launchpad PumpSwap have generated millions of microtransactions, pushing activity higher. - Active DeFi and NFT Communities

Solana’s DeFi TVL has rebounded in 2025, and NFT volumes have surged again, both of which have contributed to a rise in daily on-chain activity. - Mobile-First Strategy

With the release of Solana Saga phones and mobile-optimized dApps, the barrier to entry for users has significantly dropped.

Solana vs. Ethereum and Other Chains

While Ethereum remains the king of value transfer, Solana has carved out dominance in terms of volume and usability. Ethereum’s weekly transactions sit around 8–9 million, whereas Solana processes 20x more.

Other L2s like Arbitrum and Base are growing fast, but still lag far behind in volume compared to Solana.

What This Means for the Future of Solana

Solana’s resurgence is more than a comeback — it’s a redefinition of what scalability looks like in crypto. The 61% dominance metric is a clear sign that:

- Developers are building on Solana.

- Users are transacting daily.

- Institutions are paying attention.

The narrative has shifted. Solana is no longer “just fast.” It’s widely adopted, used, and trusted.

Final Thoughts: The Comeback Chain That Refused to Die

Solana’s 2025 story is a masterclass in resilience. From being written off to becoming the most-used blockchain in the world, its journey is unmatched.

With scalability, developer support, and real-world adoption all aligning, Solana might just be the blockchain backbone of the next internet era.