Key Takeaways

-

Bitcoin’s volatility has dropped to match that of the S&P 500 over the past 3 months.

-

This trend suggests Bitcoin may be evolving from a speculative asset to a store of value.

-

Institutional adoption, macroeconomic stability, and tighter liquidity could be contributing factors.

-

Bitcoin’s changing volatility profile strengthens its safe-haven asset narrative.

Introduction

For years, Bitcoin has been known for its wild price swings—booms that created millionaires and busts that wiped out fortunes. But something has changed. Recent data indicates that Bitcoin’s relative volatility has declined significantly and is now on par with the S&P 500, one of the most stable stock indices in the world.

This convergence in volatility marks a potential turning point in how investors perceive Bitcoin. It suggests that the digital asset is maturing and could be transitioning into a low-risk, long-term hedge—a role traditionally occupied by gold and government bonds.

Understanding Volatility in Crypto vs. Traditional Markets

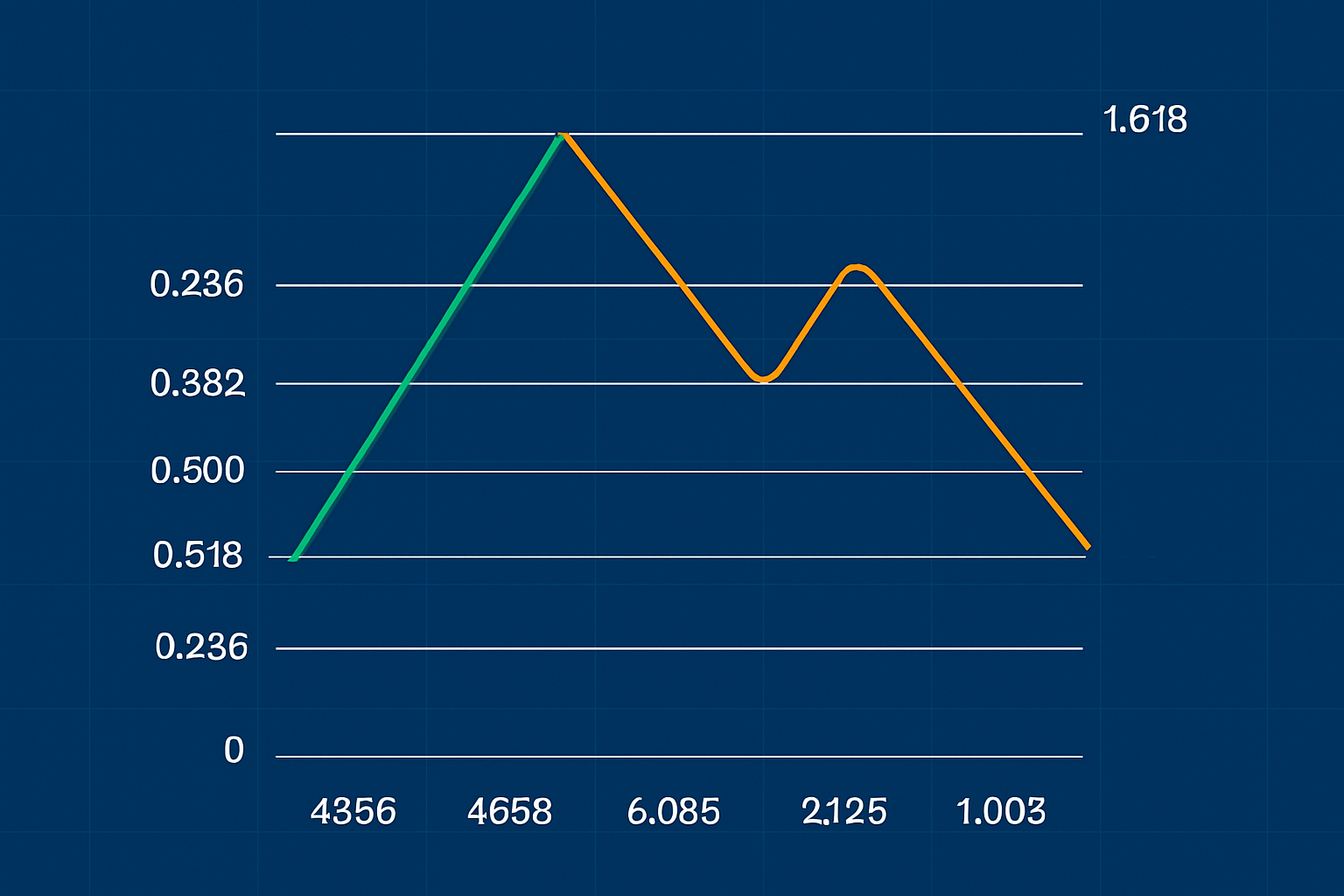

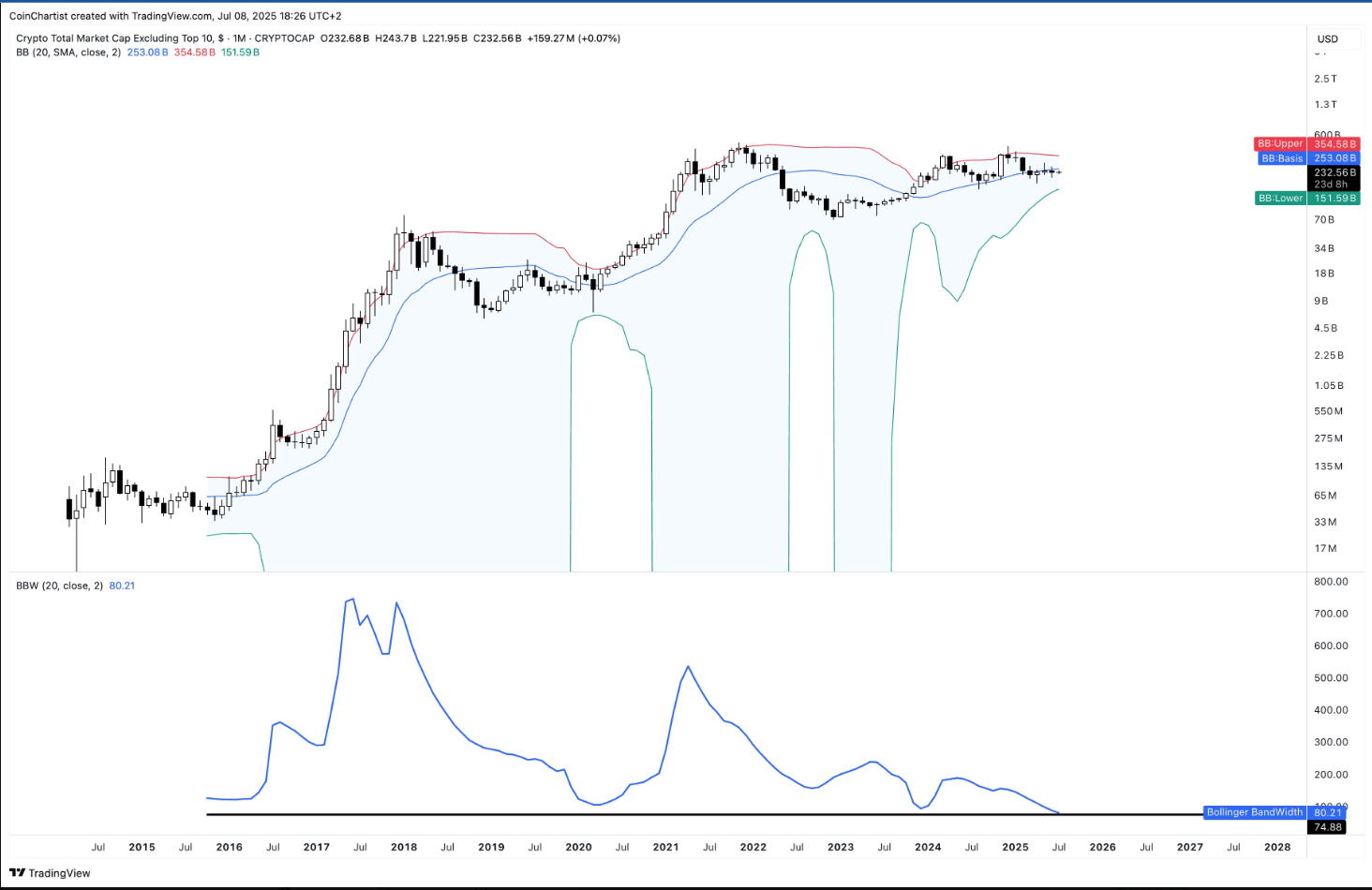

Volatility measures how dramatically an asset’s price fluctuates over time. Historically, Bitcoin’s volatility has far exceeded that of traditional financial instruments, including stocks and commodities. In 2021, for example, Bitcoin’s 30-day historical volatility frequently topped 100%, while the S&P 500 typically hovered between 15–20%.

But in 2025, the story is different.

According to data referenced by analyst @digitaldaveweb3 on X (formerly Twitter), Bitcoin’s volatility over the past 3 months has dropped to match the S&P 500—a level not seen since its inception.

⚡ “$BTC’s relative volatility has been in a structural downtrend and it’s now on par with the S&P 500 over the past 3 months. Bitcoin is gradually transitioning from a risky asset to a safe-haven asset.” – @digitaldaveweb3

Why Is Bitcoin’s Volatility Declining?

Several factors may be driving this historic drop in volatility:

1. Increased Institutional Participation

More hedge funds, asset managers, and even pension funds have begun allocating to Bitcoin. Institutional players tend to take long-term positions, reducing speculative trading and stabilizing price action.

2. Regulatory Clarity

The global regulatory landscape for crypto has evolved. The approval of multiple Bitcoin ETFs and clearer tax treatment have lowered perceived risks, attracting more conservative capital.

3. Market Maturation

With over 15 years of trading history, Bitcoin now benefits from deeper liquidity, improved infrastructure (like Lightning Network), and better integration into traditional finance platforms.

4. Macro Conditions

A relatively stable U.S. interest rate environment and diminishing inflation fears may have lowered volatility across risk assets—including crypto.

Implications: Bitcoin as a Safe-Haven?

The alignment of Bitcoin’s volatility with that of the S&P 500 has major implications:

-

Diversification: Lower volatility enhances Bitcoin’s role in balanced portfolios.

-

Store of Value: Bitcoin may increasingly be seen as digital gold.

-

Adoption by Risk-Averse Investors: A lower-risk profile could attract retail investors, family offices, and sovereign wealth funds.

While volatility alone doesn’t determine whether an asset is truly a haven, it’s a strong signal of increased market trust and maturity.

Is Bitcoin Losing Its Edge?

Some critics may argue that reduced volatility means less opportunity for traders who thrive on large price swings. However, for long-term holders and institutions, this could be a net positive. The maturation of Bitcoin aligns with the broader adoption trend, where price stability is a feature, not a bug.

Closing Thoughts

Bitcoin’s structural downtrend in volatility and its newfound parity with the S&P 500 is not just a statistical footnote; it’s a signal of evolution. It reflects years of infrastructure development, mainstream integration, and changing investor sentiment.

Whether Bitcoin is truly becoming a safe-haven asset remains to be seen. But if the current trend continues, the narrative may shift permanently—from “digital speculation” to “digital stability.”

As always, investors should do their research and understand that past performance doesn’t guarantee future results. But if volatility is any indication, Bitcoin’s wild early days may finally be giving way to something bigger—and perhaps safer.