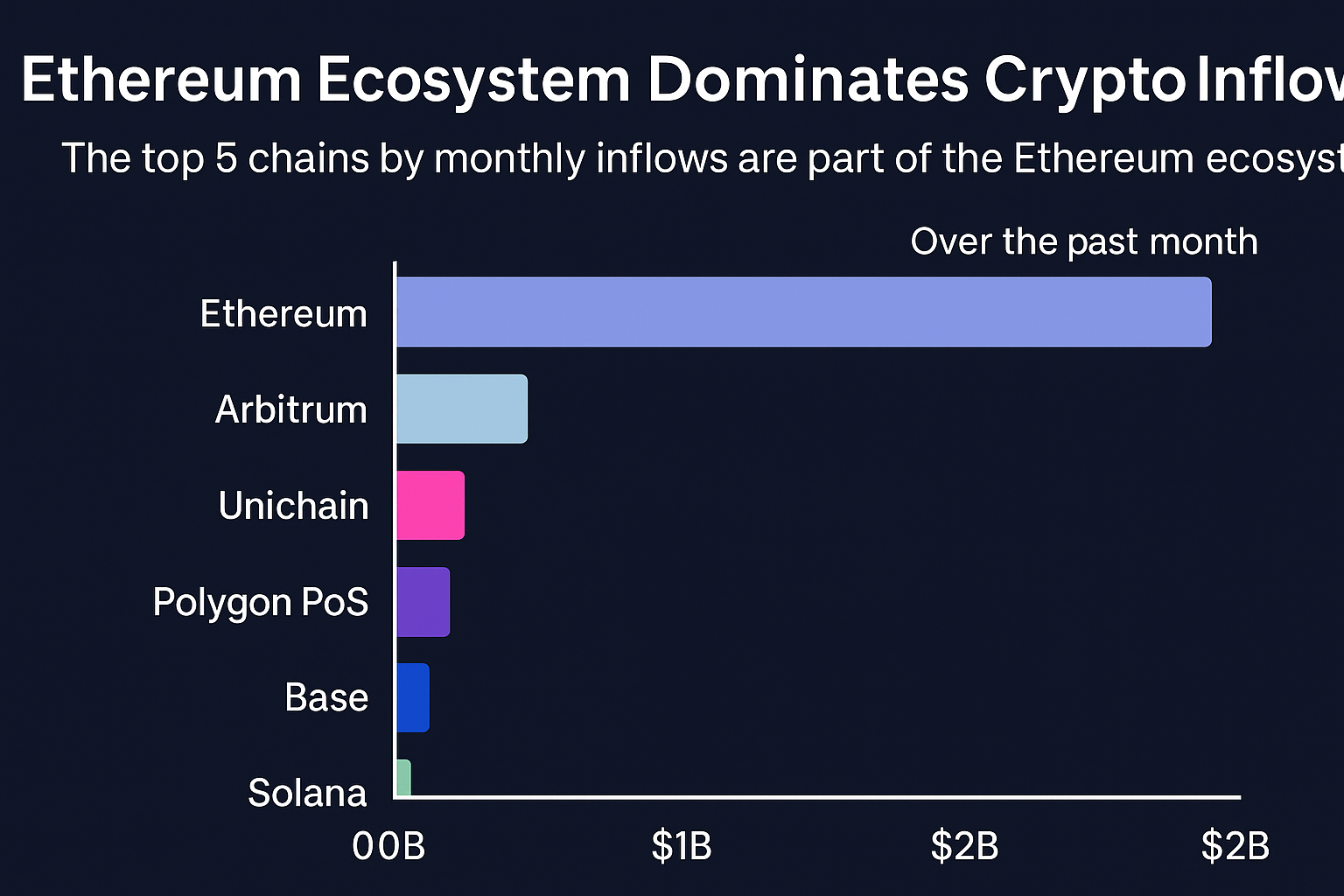

Ethereum and Layer‑2 Take Center Stage

Recent data shows Ethereum collected ~$475 million in net inflows in April, followed closely by Arbitrum, Polygon PoS, Base, and Unichain. This marks a strong reversal following earlier outflows, highlighting renewed confidence in Ethereum and its ecosystem.

What Caused the Surge?

1. Ethereum Regaining Trust

After previous capital declines, Ethereum reclaimed the top spot with significant monthly inflows, signaling growing investor confidence.

2. Layer‑2 Growth Boosts L1 Returns

Capital moved from L1 to L2s (like Base and Arbitrum), but flows are circling back as L2 gains are realized.

3. Tech and Ecosystem Upgrades

Upgrades like Polygon’s AggLayer and Base’s Flashblocks drive more utility, which translates into real capital movement.

Why It Matters — Simplified

-

Market trust returning – Capital backing Ethereum suggests renewed belief in its long-term value.

-

Ecosystem synergy – Inflows to L2s help Ethereum indirectly by boosting overall utility and confidence.

-

Mainstream momentum – Institutional crypto products, like Ethereum ETFs, adding ~$743M recently, are playing a key role.

What This Means for Everyday Users

-

Stronger Ethereum as a foundation – Apps and tokens built on Ethereum may grow in usage and value.

-

More power in Layer‑2s – Faster, cheaper chains like Base and Arbitrum are benefiting from reinvestment.

-

Better crypto experience – Ongoing upgrades mean lower fees and improved access to decentralized finance.

What’s Next?

-

Continued inflows could drive new ETH all-time highs, especially with stable demand.

-

Expect further innovations in L2 efficiency, security, and features.

-

Institutional interest—like ETF investment into Ethereum and stablecoins (~$125B)—may continue steering the trend.

Final Word

Ethereum is trending back in favor, cemented by nearly $500 million in monthly net inflows and renewed Layer‑2 activity. This momentum is a powerful sign of structural confidence in the crypto ecosystem. For regular users and investors, it means better infrastructure, faster transactions, and a maturing market that’s becoming less speculative and more constructive.