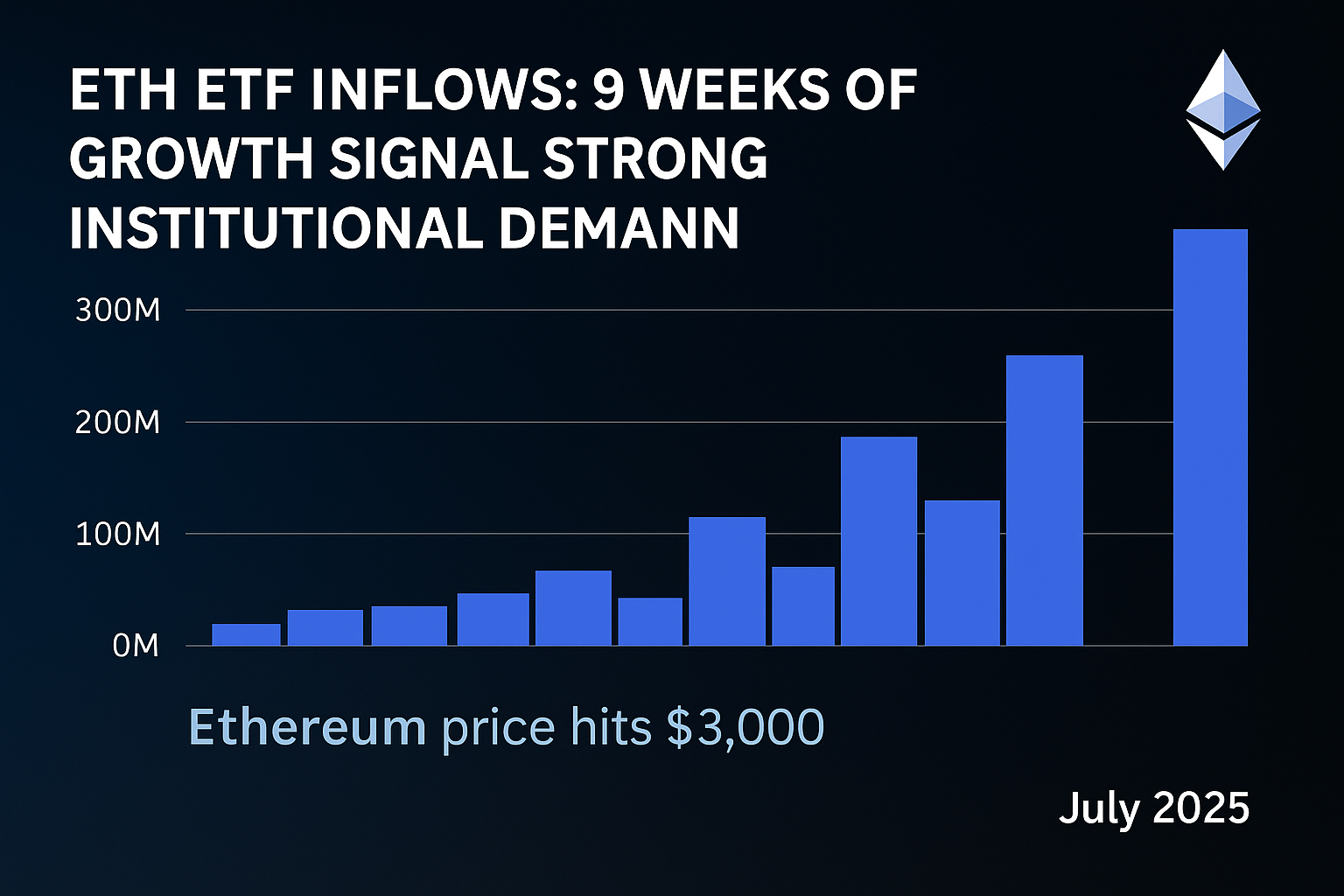

9 Weeks of Positive $ETH ETF Inflows

Recent data confirms that Ethereum spot ETFs have recorded 9 consecutive weeks of positive net inflows, underscoring sustained institutional demand for $ETH.

- One X post (likely from Glassnode/SosoValue) highlighted this 9-week streak, with last week’s inflows reaching $703 million, representing the strongest weekly inflow since the spot-ETF launch.

- Other sources note the inflow was “five times above average” this week (~$530M), a peak not seen since December 2024.

These figures are independently validated by reputable sources like The Defiant and CryptoNews (via SosoValue), confirming consistent upward trends in institutional investment.

Why Institutional Inflows Are Soaring

Spot ETFs bring simplicity

Spot ETFs allow big investors to gain exposure to ETH without managing keys or custody directly. This traditional asset wrapper aligns with familiar investment structures, making it ideal for banks and asset managers.

Growing confidence in Ethereum

Increased inflows reflect trust in Ethereum’s ecosystem:

- Staking adoption: Over 34 million ETH are locked in proof‑of‑stake contracts (~28% of supply), showing strong long-term belief.

- Futures activity: CME ETH futures open interest has surged to around $3.27 billion — the highest since February.

Institutional investors perceive Ethereum as a programmable, yield-generating asset, more than just a speculative token.

Record-Breaking Inflows & Recent Highlights

- On July 9, US ETH spot ETFs saw approximately $211 million in inflows—the second-biggest in 5 months, behind a $307M inflow in February.

- For the past week, net inflows surpassed $530 million, marking the strongest performance since December 2024.

- Weekly accumulations over 61,000 ETH have been recorded during this streak.

ETH Price Reaction & Market Impact

Ethereum’s price has surged from ~$1,800 to the $2,700–3,000 range—up roughly 50–66%—driven by these inflows.

- ETH closed above $2,700 recently, rekindling bullish sentiment and signaling potential for a move toward $3,000.

- This coincides with inflows, staking growth, and rising futures interest—all industry signals that support a strong rally.

What This Means for Traders & Investors

- Institutional involvement strengthens legitimacy

Regular inflows reflect growing trust from traditional financial players in Ethereum’s long-term potential. - Liquidity and price support

Consistent demand helps stabilize price floors and increases trading volumes, which hedges against downslide risks. - Ecosystem growth

Higher inflows often correlate with increased developer activity and growth in on-chain use cases. - Spot ETFs vs futures products

Institutional preference for spot ETFs (not just futures-based) signals a maturing investment structure around ETH.

Deep Dive: Data by the Numbers

| Metric | Value |

|---|---|

| Consecutive positive inflow weeks | 8–9 |

| Peak weekly inflow | ≈ $530M |

| July 9 inflow | $211M (2nd highest in 5 months) |

| Accumulated inflow | 61,000+ ETH weekly |

| ETH trading range | $2,700–$3,000 |

Sources: Glassnode overview, SosoValue, The Defiant, CryptoNews

What’s Next? Outlook for ETH (H2: “ETH future outlook”

- Sentiment remains bullish as inflows and open interest maintain upward momentum.

- Key range to watch: ETH must hold above $2,650–2,750; clearing $3K could trigger a stronger surge.

- Potential resistance exists if inflows slow or major profit-taking occurs, making the upcoming weeks pivotal.

Conclusion: ETH ETFs Cement Institutional Adoption

Ethereum spot ETF inflows—including a 9-week streak, a $530M weekly peak, and 61,000 ETH in accumulations—signal a strong shift toward institutional mainstreaming. With staking growth and futures momentum in play, ETH is increasingly viewed not just as a digital asset but as a legitimate institutional asset class.