Record-Breaking DEX Activity

Monthly trading on decentralized exchanges (DEXs) is approaching an all-time high of around $500 billion, nearly matching their peak in mid-2022. Platforms like PancakeSwap have driven the surge, with more than $513.5 billion in monthly volume at one point.

What’s Driving this Boom?

1. Dominance of PancakeSwap

On BNB Smart Chain, PancakeSwap has become the top DEX, processing $513.5 billion in one month and capturing over 60% of weekly DEX volume.

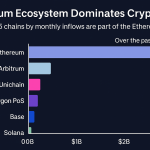

2. Shift from Ethereum

Ethereum’s DEX share is declining as traders move to cheaper, faster chains like BNB and Polygon .

3. DEX vs CEX Ratio Hits New Highs

Volume on DEX futures is now about 8% of centralized exchange volumes, the highest ever, showing confidence in decentralized platforms. In broader trading, the spot DEX-to-CEX ratio reached 27.9%, the highest to date.

Why It Matters — Explained Simply

More users are choosing DEXs for faster trades, lower fees, and self-custody control.

The record volumes show real demand for decentralized DeFi services.

The rise in DEX usage signals growing maturity in the crypto ecosystem, with alternative chains competing with Ethereum.

How Ordinary People Benefit

Lower fees: Chains like BNB offer cheaper swaps than Ethereum.

Greater control: No middleman — users manage their own funds via wallets.

More options: Users can trade a wider range of assets across multiple chains.

What’s Next for DEXs?

Continued innovation on platform features, like one-click cross-chain swaps.

Potential shift back to Ethereum with upcoming upgrades (e.g., Uniswap v4).

Increased market share for BNB-powered DEXs unless Ethereum keeps pace.

Final Takeaway

DEXs are no longer niche. Monthly volumes approaching $500 billion show a clear shift toward decentralized finance. With user-friendly features, low fees, and growing infrastructure, DEXs are increasingly the mainstream way to trade crypto.

You Might Also Like

Binance Connect: The Future of Fiat-to-Crypto Onboarding

Discover how Binance Connect is breaking down barriers between traditional finance and Web3 with seamless fiat-to-crypto integration.

Is Qubic One of the World’s Top 10 Most Powerful (and Decentralized) Supercomputers?

Explore how Qubic merges decentralized architecture with AI supercomputing to push the limits of Web3 infrastructure.

WinkLink Oracles & AI Agents: Boosting Web3 Trust

Learn how WinkLink’s AI-powered oracles are enhancing smart contract reliability across DeFi, gaming, and more.